ValOre Expands PGE Mineralization at Pedra Branca with Step-Out Drilling; Intersects 9.49 g/t 2PGE+Au over 2.45 metres

August 31, 2020

Vancouver, B.C. ValOre Metals Corp. ("ValOre"; the “Company”; TSX‐V: VO; OTC: KVLQF; FRANKFURT: KEQ0) today announced assay results from the ongoing Phase 1 core drill program at ValOre’s 100%-owned Pedra Branca Platinum Group Elements Project in northeastern Brazil. Assay results for the final three of five holes drilled at the Trapia 1 target are reported herein.

Highlights from ValOre’s Initial Drilling at Trapia 1:

- Drill hole DD20TU13

- Successfully expands Trapia 1 mineralization with 140 metre step-out along strike to the south

- 9.49 g/t 2PGE+Au (Palladium, Platinum and Gold; Pd, Pt+Au) over 2.45 metres (m) within a broad mineralized ultramafic (“UM”) unit 0.76 g/t 2PGE+Au over 61.85 m from 217.50 m downhole;

- Drill hole DD20TU14

- Extends the down-dip mineralization at Trapia 1 in the northern portion of the resource area, and shows a thickening of the mineralized body at depth;

- 1.27 g/t 2PGE+Au over 5.00 m, within a broader interval of 0.60 g/t 2PGE+Au over 21.55 m from 118.80 m downhole;

- Initial drill results indicate that the large 3D magnetic inversion target extending approximately 1 kilometre from the Trapia 1 resource represents an intact and mineralized intrusion;

- Mineralization remains open in all directions, with multiple drill holes planned for immediate follow-up;

- Trapia 1 orebody has been shown to be thickening with depth across the entire width of the resource, and remains thick (61.85 m) in newly drilled areas south of the resource

ValOre’s Chairman and CEO, Jim Paterson, stated: “Our Phase 1 drilling has successfully identified near surface mineralization in the southern portion of the current Trapia 1 resource area; extended and thickened the easterly down-dip mineralization across the full width of the resource; and proven that the mineralized ultramafic intrusion remains intact and open to expansion along a 1 kilometre geophysical target to the south. We plan to return to Trapia 1 near the end of Phase 1 due to the considerable resource expansion potential.”

Trapia Target Area and the 2019 NI 43-101 Resource

Trapia represents one of the five currently known PGE deposit areas which host NI 43-101 resources at Pedra Branca. ValOre reported a NI 43-101 inferred resource estimate for Pedra Branca in August, 2019, which totalled 1,067,000 ounces 2 PGE+Au contained in 27.2 million tonnes (“Mt”) grading 1.22 g/t 2PGE+Au. PGE mineralization for all five of the resource deposit areas outcrops at surface, making these inferred resources prospective for open pit mining. Figure 1, shows the location of the five NI 43-101 deposit areas and ValOre’s proposed 2020 drill holes.

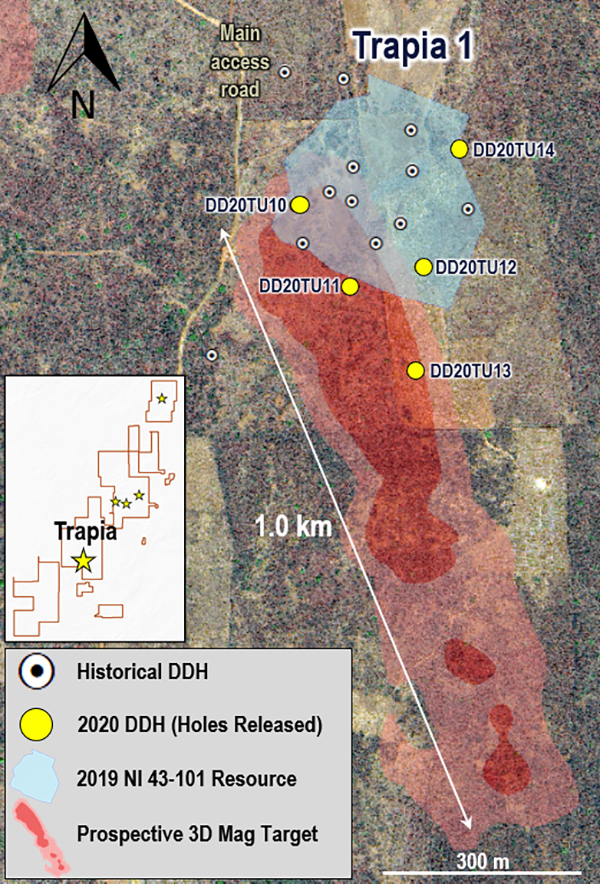

The Trapia resource is comprised of three separate deposit areas within a 2-kilometre radius: Trapia 1, Trapia 2 and Trapia West. Specifically, Trapia 1 represents 92,000 ounces of the aggregate Trapia resource of 219,000 ounces at 1.1 g/t 2PGE+Au (6.2 Mt). Figure 2 shows the location of the Trapia target areas (Trapia 1, Trapia 2 and Trapia West), proposed and drilled 2020 drill holes, and prospective 3D magnetic inversion drill targets.

Trapia 1 was selected for Phase 1 of the 2020 drill program on the merits of its strong resource expansion potential and high prospectivity along strike to the south, which correlates with a 3D magnetic inversion target extending approximately 1 kilometre from the currently defined resource. A total of 900 metres were drilled in five drill holes, testing both the PGE mineralization open at depth to the east and the 3D magnetic inversion target. Table 1 and Figure 3 present a summary of 2020 Phase 1 drilling at Trapia 1.

Figure 3: Trapia 1 Target with Location of 2020 Drill Holes, Resource and 3D Mag Inversion Target

Trapia 1 2020 Drilling Results

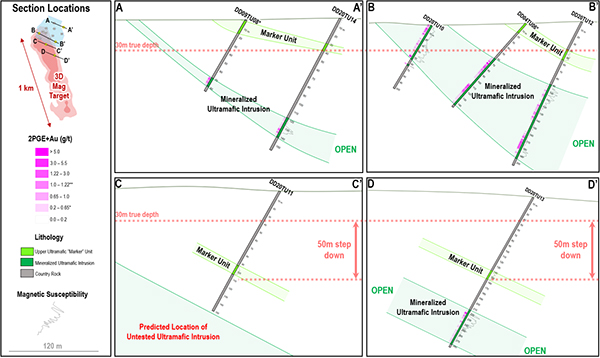

Ultramafic rocks were intercepted in all five drill holes at Trapia 1 (DD20TU10 to DD20TU14), with four of the five holes returning strong 2PGE+Au assay results. Drill hole DD20TU13 successfully expanded Trapia 1 mineralization by stepping out 140 metres along strike to the south along a 1 kilometre long 3D magnetic inversion target. This drill hole was also critically important in validating a robust geological and structural model for the southern resource expansion target, demonstrating a ~50 metre down-stepping of the mineralized intrusion. In addition, drill hole DD20TU14 targeted the down-dip extension of mineralization in the northern Trapia 1 resource area, and successfully doubled the thickness of mineralized intrusion from the most proximal up-dip historical drill hole, DD09TU08. See Figure 4 for cross sections through all five Phase 1 drill holes at the Trapia 1 target area.

DD20TU13 targeted the southerly strike extension of Trapia 1 mineralization along the kilometre-scale long 3D magnetic inversion target, 140 metres south of the nearest mineralized intercept, DD20TU12. ValOre geologists identified an Ultramafic “Marker” Horizon in the upper sections of historical Trapia 1 resource holes to the north, as well as in DD20TU12 (from 31.95 to 36.85 metres) and DD20TU14 (from 121.00 to 140.35 metres). This stratigraphically significant marker unit was also encountered in DD20TU12; however, the anticipated target depth was encountered approximately 50 metres deeper down hole than expected. As such, it was interpreted that the entire, intact geological package associated with the Trapia 1 resource to the north had also been stepped down 50 metres. DD20TU13 was accordingly extended past the original planned length, and intersected 61.85 metres of mineralized ultramafic intrusion, grading 0.76 g/t 2PGE+Au from 217.15 m downhole, including 9.49 g/t 2PGE+ Au over 2.45 metres from 221.20 m. The down-stepped structural and geological model for the target area south of the resource was substantiated by the intercept in DD20TU13, which transected a stratigraphically-intact, mineralized, Trapia 1 resource-associated orebody that was approximately 50 metres deeper than the anticipated target depth.

The implications of this geological model are significant for DD20TU11, which aimed to target mineralization immediately south of the Trapia 1 resource, 140 m northwest of DD20TU13, and within the same 1 kilometer long magnetic target. The drilling and analysis of DD20TU11 preceded the now validated down-stepped structural model, and consequently, it is believed that DD20TU11 (the only Phase 1 Trapia 1 drill hole which lacked grade) was stopped short of the target intrusion, and thus remains open to a mineralized intercept at depth.

DD20TU14 targeted the down-dip extension of mineralization in the northern Trapia 1 resource area, and successfully doubled the thickness of mineralized intrusion from the proximal up-dip historical drill hole, DD09TU08. DD20TU14 returned 0.60 g/t 2PGE+Au over 21.55 m from 118.80 m downhole, including 1.27 g/t 2PGE+Au over 5.00 m from 132.00 m. For comparison, the up-dip, historical resource drill hole, DD09TU08, intercepted 0.83 g/t 2PGE+Au over 11.30 m. PGE mineralization remains open at depth.

Trapia 1 PGE mineralization remains open down-dip to the east, up-dip to the west along the isoshell, and along strike to the north and south, with multiple drill holes planned for immediate follow-up. 3D magnetic inversion target extending ~1 kilometre from Trapia 1 resource was shown in DD20TU13 to represent an intact, mineralized, down-stepped resource-associated intrusion, previously undrilled and untested. Consequently, DD20TU11 represents a high-priority hole to re-enter and extend, with the 50-metre stepped-down.

In summary, Phase 1 drilling at Trapia 1 has effectively brought mineralization to surface in the southern resource area, extended and thickened the easterly down-dip mineralization across the full width of the resource that remains fully open at depth, and proven that the mineralized ultramafic intrusion remains stratigraphically intact and wide open to expansion at least 140 metres to the south of DD20TU12, within a highly-prospective 1 kilometre long 3D magnetic inversion target. High-priority follow up drill holes have been planned for immediate execution at the end of Phase 1, including stepping further out along strike from DD20TU13, along the 1 kilometer long magnetic target, stepping west of DD20TU13 to target a shallower 2PGE+Au intercept, re-entering and extending DD20TU11 to depth (as directed by the down-stepped model), and further extending the resource mineralization down-dip.

Table 2: Summary of Significant Core Assay Results from DD20TU13 and DD20TU14

| Drill Hole | Depth From (m) | Depth To (m) | Interval (m)* | 2PGE+Au (g/t) |

| DD20TU13 | 217.05 | 279.00 | 61.85 | 0.76 |

| Including | 221.20 | 223.65 | 2.45 | 9.49 |

| DD20TU14 | 118.80 | 140.35 | 21.55 | 0.60 |

| Including | 132.00 | 137.00 | 5.00 | 1.27 |

* Reported assay intervals are estimated to be 90-100% true width

Figure 4: Cross Section Summary of Phase 1 Drilling at Trapia 1

Pedra Branca 2020 Drill Program

Please see ValOre’s news release from August 25, 2020 for detailed information regarding:

- Pedra Branca 2020 Drill Program (Phase 1 and Phase 2)

- Quality Control/Quality Assurance (“QA/QC”) and Grade Interval Reporting

- Analytical Procedures, SGS Geosol

- About Servitec Foraco Sondagem SA

- ValOre and Servitec Foraco COVID-19 Protocols

http://valoremetals.com/news-media/news-releases/2020/

About ValOre Metals Corp.

ValOre Metals Corp. (TSX‐V: VO) is a Canadian company with a portfolio of high‐quality exploration projects. ValOre’s team aims to deploy capital and knowledge on projects which benefit from substantial prior investment by previous owners, existence of high-value mineralization on a large scale, and the possibility of adding tangible value through exploration, process improvement, and innovation.

In May 2019, ValOre announced the acquisition of the Pedra Branca Platinum Group Elements (PGE) property, in Brazil, to bolster its existing Angilak uranium, Genesis/Hatchet uranium and Baffin gold projects in Canada.

The Pedra Branca PGE Project comprises 38 exploration licenses covering a total area of 38,940 hectares (96,223 acres) in northeastern Brazil. At Pedra Branca, 5 distinct PGE+Au deposit areas host, in aggregate, a NI 43-101 Inferred Resource of 1,067,000 ounces 2PGE+ Au contained in 27.2 million tonnes grading 1.22 g/t 2PGE+Au (see ValOre’s July 23, 2019 news release). PGE mineralization outcrops at surface and all of the currently known inferred resources are potentially open pittable.

Comprehensive exploration programs have demonstrated the "District Scale" potential of ValOre’s Angilak Property in Nunavut Territory, Canada that hosts the Lac 50 Trend having a NI 43‐101 Inferred Resource of 2,831,000 tonnes grading 0.69% U3O8, totaling 43.3 million pounds U3O8. ValOre's. For disclosure related to the inferred resource for the Lac 50 Trend uranium deposits, please refer to ValOre's news release of March 1, 2013.

ValOre’s team has forged strong relationships with sophisticated resource sector investors and partner Nunavut Tunngavik Inc. (NTI) on both the Angilak and Baffin Gold Properties. ValOre was the first company to sign a comprehensive agreement to explore for uranium on Inuit Owned Lands in Nunavut Territory and is committed to building shareholder value while adhering to high levels of environmental and safety standards and proactive local community engagement.

Qualified Person

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Colin Smith, P.Geo., who oversees New Project Review for ValOre.

On behalf of the Board of Directors,

"Jim Paterson"

James R. Paterson, Chairman and CEO

ValOre Metals Corp.

For further information about, ValOre Metals Corp. or this news release, please visit our website at valoremetals.com or contact Investor Relations toll free at 1.888.331.2269, at 604.646.4527, or by email at [email protected].

ValOre Metals Corp. is a proud member of Discovery Group. For more information please visit: discoverygroup.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains “forward-looking statements” within the meaning of applicable securities laws. Although ValOre believes that the expectations reflected in its forward-looking statements are reasonable, such statements have been based on factors and assumptions concerning future events that may prove to be inaccurate. These factors and assumptions are based upon currently available information to ValOre. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated or implied in the forward-looking statements. A number of important factors including those set forth in other public filings could cause actual outcomes and results to differ materially from those expressed in these forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the future operations of the Company and economic factors. Readers are cautioned to not place undue reliance on forward-looking statements. The statements in this press release are made as of the date of this release and, except as required by applicable law, ValOre does not undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. ValOre undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of ValOre, or its financial or operating results or (as applicable), their securities.